If you speak out against the Bahamas real estate market, you’d better watch out.

Those who have dared to expose the corruption and lack of transparency in the Bahamian real estate market have suffered consequences.

You can forget about buying or selling property, or even claiming title to any land that you own.

Lawyers, who play a big role in the lack of transparency and corruption in the industry, will shun you, making proper legal representation an impossibility.

Whatever property you do own will be vandalized and buildings will be broken into. You essentially have no property rights if you speak out against the industry.

While there are many honest, ethical real estate brokers and attorneys in The Bahamas, there are also many who appear to be legitimate and reputable, though they are not.

The Bahamas Real Estate Association has as its president the son of a prominent businessman whose nickname is ‘snake’, presumably due to his serpent-like business dealings.

In the late 1980s, during the height of drug-fueled illegal activity in the country, many of the top real estate firms in The Bahamas conspired together to steal over $50 million worth of crown land, and divied it up amongst themselves to sell.

In The Bahamas, in the absence of a proper land registry, property titles are like lottery tickets… whoever is holding the certificate of title has claim to ownership.

Also, the quieting of titles has been used for years to steal land from unsuspecting owners. Fortunes have been made from this “legally stolen” land.

In one of the most spectacular unsolved crimes of the last century, billionaire Harry Oakes was rumoured to have been murdered so the Bahamas real estate mafia could steal his extensive land holdings in The Bahamas.

It is not uncommon for Bahamian lawyers to handle real estate transactions and keep the money for themselves, rather than give it to the client they represented.

This was the case of the late PLP co-founder William ‘Bill’ Cartwright, who died recently – ignored, broke and forgotten – in a nursing home in The Bahamas. Mr Cartwright hired prominent PLP lawyers, who are now members of Parliament, to handle a couple of real estate transactions involving the sale of property worth hundreds of thousands of dollars. The lawyers never gave Mr Cartwright his money after the sale.

There are numerous similar stories of Bahamian lawyers and real estate brokers whose consciences are apparently untroubled by their own rampant greed.

Such is the climate of entitlement among far too many Bahamian laywers and real estate brokers.

In 2008, after a lawyer stole the life savings – proceeds of a property deal – from a single mother, John Marquis, the former managing editor of The Tribune, wrote this about Bahamian lawyers:

“There is such poor standards of regulation within the profession, that the more avaricious of them believe they have carte blanche to exploit others with little or no fear of repurcussion.

They trade on the public’s perceived ignorance on legal matters and their own expertise in intrigue and obfuscation, to milk the unsuspecting without mercy, always in the belief that their professional brotherhood will protect them, whatever the circumstances.”

Many of these crooked lawyers are working in cahoots with equally corrupt real estate brokers, and even bankers who finance the transactions.

Recent investigations in The Bahamas have shown that the proceeds of crime are allegedly invested in large real estate acquisitions. Some luxury properties are simply flipped every few years from one broker to another, with the brokers claiming to represent vaguely identifed foreign owners whose real intention is to launder funds.

The relationship between laywers, real estate brokers, money launderers and organised crime in The Bahamas is not a new one.

Back in the days of the Bay Street Boys, big business in The Bahamas was allegedly dominated by a clique of sordid, international big-money elements in alliance with the Jewish crime syndicate which was, in turn, collaborating with the CIA and Israel’s Mossad in an array of inter-connected money-laundering operations.

The casinos laundered money for the CIA and the Mossad. In return, these agencies used their influence to ensure the mob remained protected from interference by law enforcement.

In one of the largest real estate transactions of its time, the first casino on Paradise Island was created by a CIA front called the Mary Carter Paint Company, which was set up in the 1950s by then-CIA director Allen Dulles and his close associate, New York Gov. Thomas E. Dewey. While the company did in fact operate a national paint store chain, its real purpose was to function as a covert CIA money-laundering operation, according to Michael Collins Piper, a reputable author who has written several books detailing the operations of organised crime.

In 1963 the company spun off its paint division and began focusing on its casino operations, particularly in the Bahamas. In 1967 and 1968 Mary Carter changed its name to Resorts International and expanded. Today, the property is known as the Atlantis Resort.

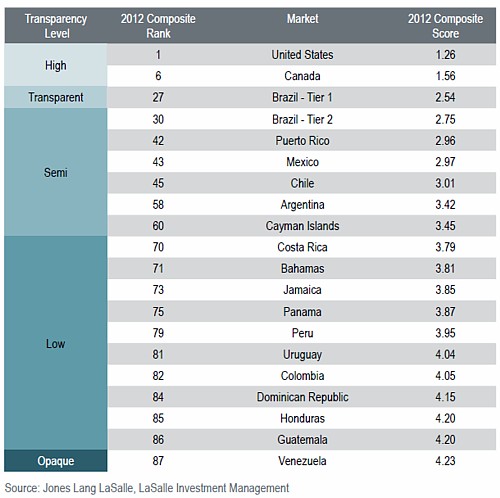

In a recent survey by Jones Lang LaSalle and LaSalle Investment Management, The Bahamas ranked number 71 out of 97 countries in terms of transparency in their real estate market.

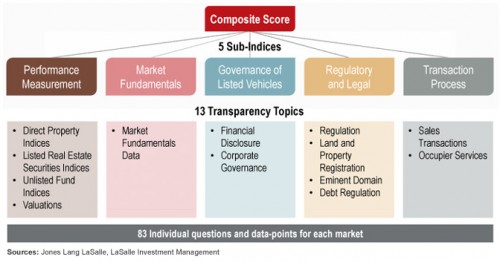

The Global Real Estate Transparency Index [PDF], first published in 1999, is based on a combination of quantitative market data and information gathered through a survey of the global business network.

The survey noted that countries that have increased transparency in their real estate industries are recovering from the global recession at a faster rate than those who have not embraced transparency.

In The Bahamas, the pace of regulatory and legal reform has been slow, and there has been limited improvement on the transparency of transaction processes, despite recognition by government and industry bodies that transparent real estate markets are necessary.

The current lack of performance indicators and accurate market information continues to hinder inward investment and hampers the development of competition in the domestic real estate sector.